#4 Ask China: China’s Response to Global Reactions on Rare Earth Regulations

Amid rising global competition over resources, China’s rare earth policy highlights lawful governance, supply chain stability, and cooperation to balance security with sustainability.

Welcome to the 60th edition of our newsletter! I’m SUN Chenghao, a fellow with the Center for International Security and Strategy (CISS) at Tsinghua University, Council Member of The Chinese Association of American Studies, a visiting scholar at Paul Tsai China Center of Yale Law School in 2024 and Munich Young Leaders 2025.

ChinAffairsplus is a newsletter that shares articles by Chinese academics on topics such as China’s foreign policy, China-U.S. relations, China-Europe relations, and more. This newsletter was co-founded by my research assistant, ZHANG Xueyu, and me. Through carefully selected Chinese academic articles, we aim to provide you with key insights into the issues that China’s academic and strategic communities are focused on. We will highlight why each article matters and the most important takeaways. Questions and feedback can be addressed to sch0625@gmail.com.

In this newsletter, we address concerns about China’s positions through a Q&A format, while also presenting key points of leading Chinese scholars’ commentaries. Through this series, we aim to provide policymakers, think tanks, and strategic communities overseas with access to Chinese scholars’ views, accompanied by curated academic perspectives that help readers better understand the considerations underlying China’s foreign policy choices.

Background

On October 9, China’s Ministry of Commerce announced two new export control measures on rare earth items and related technologies, effective December 1. The policies mark a major step in refining China’s governance over strategic resources amid intensifying global supply chain competition. According to the Ministry, the controls comply with international law and aim to safeguard peace, prevent proliferation, and protect national and environmental security. The new rules introduce “minimum content” (0.1%) and “direct product” provisions, extending control to foreign-made products containing Chinese-origin rare earths or using related Chinese technologies. Strategically, the regulation serves as a proportionate countermeasure or “pushback” to the escalating U.S.-led technology blockades. However, the U.S. often interprets this move as an offensive action rather than a defensive response, warning of further tariff escalation, adding more tension to U.S.-China relations.

Ask China

The answers expressed here do not necessarily reflect those of our newsletter. They are drawn from articles and commentaries written by Chinese scholars.

China’s rare-earth export controls clearly reflect a strategic shift from passive response to active game-shaping amid the long-term normalization of external disruptions. This policy is no longer a temporary bargaining chip but a long-term strategic instrument serving national security, technological upgrading, and the restructuring of global supply chains.

From the perspective of domestic industrial governance, the measure is not an emotional reaction but rather a natural extension of more than a decade of legal, ecological, and sustainable reforms in China’s rare-earth management system. It aims to address long-standing structural issues, including disorderly mining and excessive environmental costs. Although China possesses the world’s largest rare-earth reserves, it has long lost pricing power due to market fragmentation and unfair competition. Recent regulations, including the Regulations on the Administration of Rare Earths and the Export Control Regulations on Dual-Use Items, strengthen legal oversight and quota management, guiding the industry toward standardization and high-quality growth while transforming resource endowments into sustainable national competitiveness.

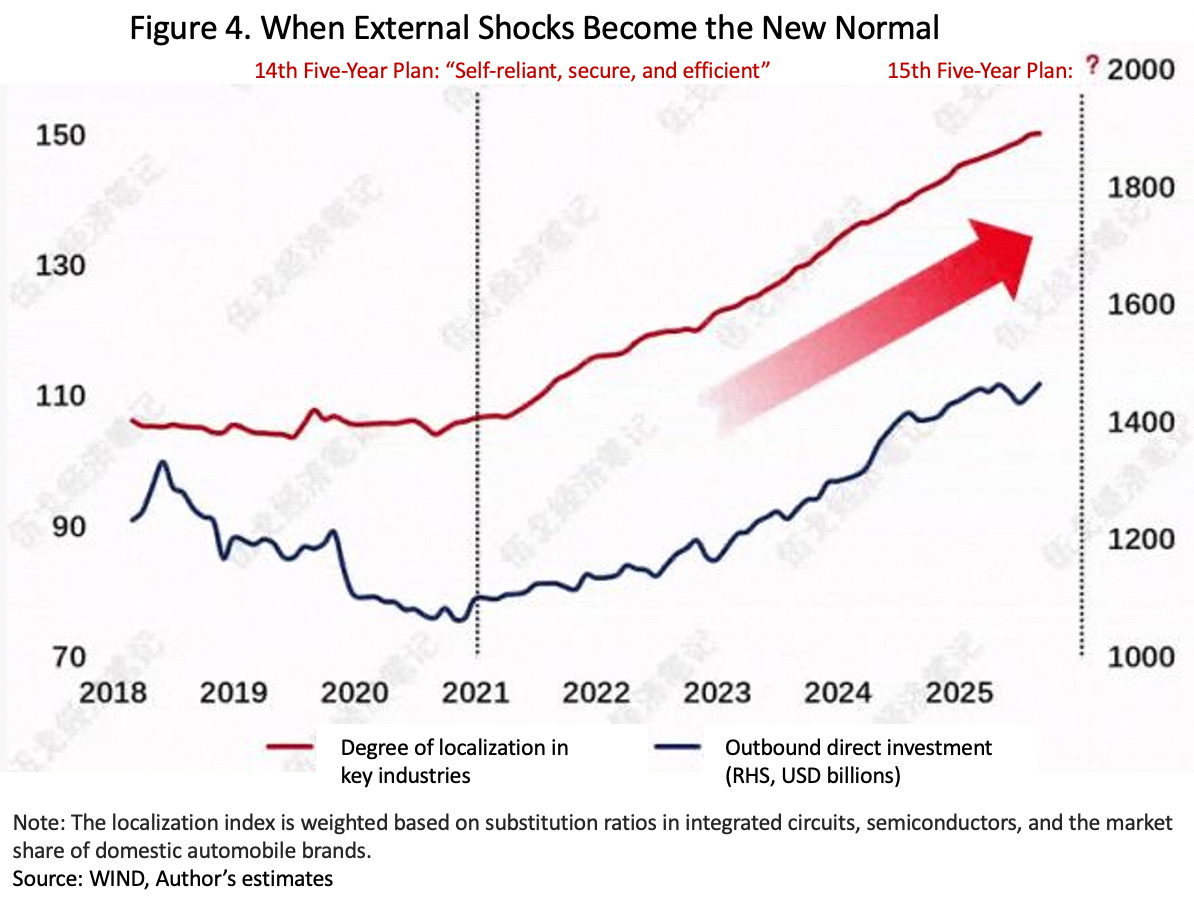

At the external level, China’s countermeasures are no longer a form of defensive retaliation in the China-U.S. trade conflict but carefully evaluated, institutionalized actions that demonstrate Beijing’s growing control over the dynamics of strategic competition. Rare-earth export controls, outbound investment, and domestic substitution reinforce each other and together form the dual pathway through which China is addressing the normalization of external shocks during the 15th Five-Year Plan period.

From a global economic and governance perspective, China’s rare-earth policy represents rule-based and law-based participation in global resource governance, rather than an attempt to seek geopolitical dominance through power politics. The so-called rare-earth hegemony argument ignores the regulatory logic behind China’s policy choices. In fact, major economies such as the United States and the European Union have long implemented similar export review mechanisms. China’s approach is open, transparent, and non-discriminatory, accessible to all qualified civilian end-users worldwide. This demonstrates fairness and restraint in governance. The essence of the policy is not to coerce by power, but to build credibility through regulation, a step toward greater equity and stability in resource management. It also signifies China’s constructive transition from being a rule-taker in global industrial chains to becoming an active rule-shaper.

In response to China’s newly announced rare earth export control policy, the United States and its allies are expected to adopt a series of multi-layered measures aimed at strengthening supply chain security and technological protection. This policy shift not only intensifies the strategic competition between China and the U.S. in high-tech sectors but also signifies that the trade war’s focus is moving from tariff disputes to a struggle over resource control and rule-setting power.

First, the U.S. and its allies are likely to further promote localization and diversification of rare earth supply chains. For decades, China has held a dominant position in the global rare earth market. By including certain critical rare earth products under export control and applying rules similar to the “Foreign Direct Product Rule” to restrict technology outflow, China is compelling other nations to accelerate the development of alternative mineral sources, expand strategic reserves, and invest in domestic refining and recycling industries to reduce dependence on Chinese supply.

Second, this policy will likely drive Western countries to institutionalize their response to resource security and supply chain governance. The United States may push to establish new “critical minerals partnerships,” collaborating with the EU, Japan, and Australia to form a resource alliance that minimizes reliance on China. Meanwhile, the U.S. could attempt to exert diplomatic or institutional pressure by accusing China of “market discrimination” or “weaponizing trade.” However, since China’s regulations are grounded in legal frameworks, transparent standards, and non-proliferation principles, such claims may gain limited international traction.

In the long term, China’s new regulations indicate that the China-U.S. trade conflict is entering a new phase of structural competition. Whereas earlier disputes centered on tariffs and market access, the current focus has shifted toward control over advanced technology, energy transition, and strategic resources. By strengthening its export management system, China not only prevents key materials from being diverted to potential rivals but also promotes industrial upgrading toward higher value-added and lower-energy sectors, reinforcing both technological security and economic resilience.

Overall, this policy represents China’s transition from passively responding to global trade rules to actively shaping them. The responses from the U.S. and its allies will likely accelerate a restructuring of the global rare earth supply chain. The nature of their rivalry will evolve from conventional trade friction into a long-term, institutionalized competition over resource security, technological sovereignty, and the discourse power of international economic rules. Consequently, the future China-U.S. trade war will carry deeper strategic implications, influencing not only trade but also the broader transformation of global industrial and geopolitical structures.

China’s recent upgrade of its rare earth export controls is not a temporary or radical move but a systematic effort to improve resource governance and reshape global market rules.

First, the policy aims at regulation, not confrontation. As Zhou Mi explains, the new measures “are not directed at any single country, but are legal actions taken under China’s Export Control Law to regulate strategic resources and safeguard industrial chain security” . This shows that China seeks to guide the global rare earth supply order through rule-based, lawful management, shifting from being merely a major exporter to becoming a rule-setter and standards builder.

Second, China is evolving from a ‘supplier’ to a ‘governor’ of the rare earth industry. Wang Ziyang notes that China “has moved from being the world’s largest rare earth producer to becoming a global manager of rare earth order,” emphasizing that the change lies not only in trade control but in reshaping the structure of global resource governance. By tightening technology thresholds, enhancing environmental oversight, and setting export standards, China is pushing the industry from quantity-based to quality-based competition, influencing both pricing and regulatory norms worldwide.

Third, the policy is steady rather than aggressive, signaling stability to global markets. Lin Boqiang observes that the new regulation “is not a radical policy escalation” but rather a step to clarify management boundaries and improve resource efficiency, not to trigger supply shocks. This “moderate governance” approach helps international companies adapt supply chains under clear rules and reflects China’s institutional confidence in navigating external frictions.

Finally, the move embodies China’s strategic composure amid an era of constant external disruptions. Wu Ge believes that in today’s volatile global economy, China should rely on institutional innovation and policy stability to maintain long-term resilience. The rare earth policy exemplifies this mindset, using rule-based adjustments to build a sustainable and predictable resource governance system.

Overall, China’s rare earth export reform is more than an industrial policy. It marks the country’s emergence as a responsible manager in global resource governance, strengthening its rule-making capacity and promoting a vision of a transparent, fair, and stable international market.

China Scholars’ Insights

ZHOU Mi: China’s Upgraded Rare Earth Export Controls: No Need for the United States to Overreact

Civilian Sectors Unaffected, Military Use Strictly Limited

Zhou Mi points out that rare earths, often called the “MSG of industry,” are essential for defense, automotive, and electronic production. China’s latest announcement makes it clear that rare-earth products for military use will not receive export licenses, while civilian-use materials remain unaffected. This ensures stable supply for sectors such as electric vehicles and semiconductors and helps industry players better assess market demand.

Ongoing Dialogue: Transparency Within the Rules

Since introducing export controls in April, China has continued technical consultations with partners. Zhou notes that Beijing has never halted communication. Through bilateral export-control dialogues, it proactively informs relevant countries and enterprises, assists them in understanding compliance requirements, and expedites lawful export approvals. These efforts show China’s commitment to openness, transparency, and rule-based cooperation.

Closing Loopholes: Preventing Misuse and Illegal Transfers

The purpose of this policy upgrade, Zhou emphasizes, is not to restrict trade but to fix regulatory loopholes. Some companies have diverted rare-earth materials to produce high-precision, lethal weapons, even undermining other nations’ sovereignty. Others have attempted to evade oversight through fragmented or disguised shipments. Such actions disrupt the international market order. China’s tighter control aims to ensure that rare earths are used for peaceful and legitimate purposes, protecting fairness and sustainability in global trade.

Mutual Benefit Should Remain the Bottom Line in China-U.S. Trade

Despite ongoing consultations, Washington has not eased its pressure on China. The U.S. continues to expand export-control lists, extend economic sanctions, and impose excessive fees on Chinese shipping and vessels. Zhou argues that such untrustworthy behavior undermines cooperation and introduces new uncertainty into bilateral relations. Mutual benefit—not unilateral suppression—should remain the foundation of China-U.S. economic engagement.

A Rational Response to Global Transition Challenges

As the world faces energy transition, climate change, and AI governance challenges, rare earths play a pivotal role. If major economies choose cooperation, all will share in development opportunities; if they pursue confrontation, global risks will rise. China’s law-based export control reflects a rational choice to uphold fairness and sustainability in global supply chains rather than a turn toward confrontation or protectionism.

WU Ge: When External Shocks Become the Norm

In the long run, strengthening domestic substitution in key industries and accelerating outbound investment will be China’s realistic pathways for coping with the normalization of external disruptions during the 15th Five-Year Plan period.

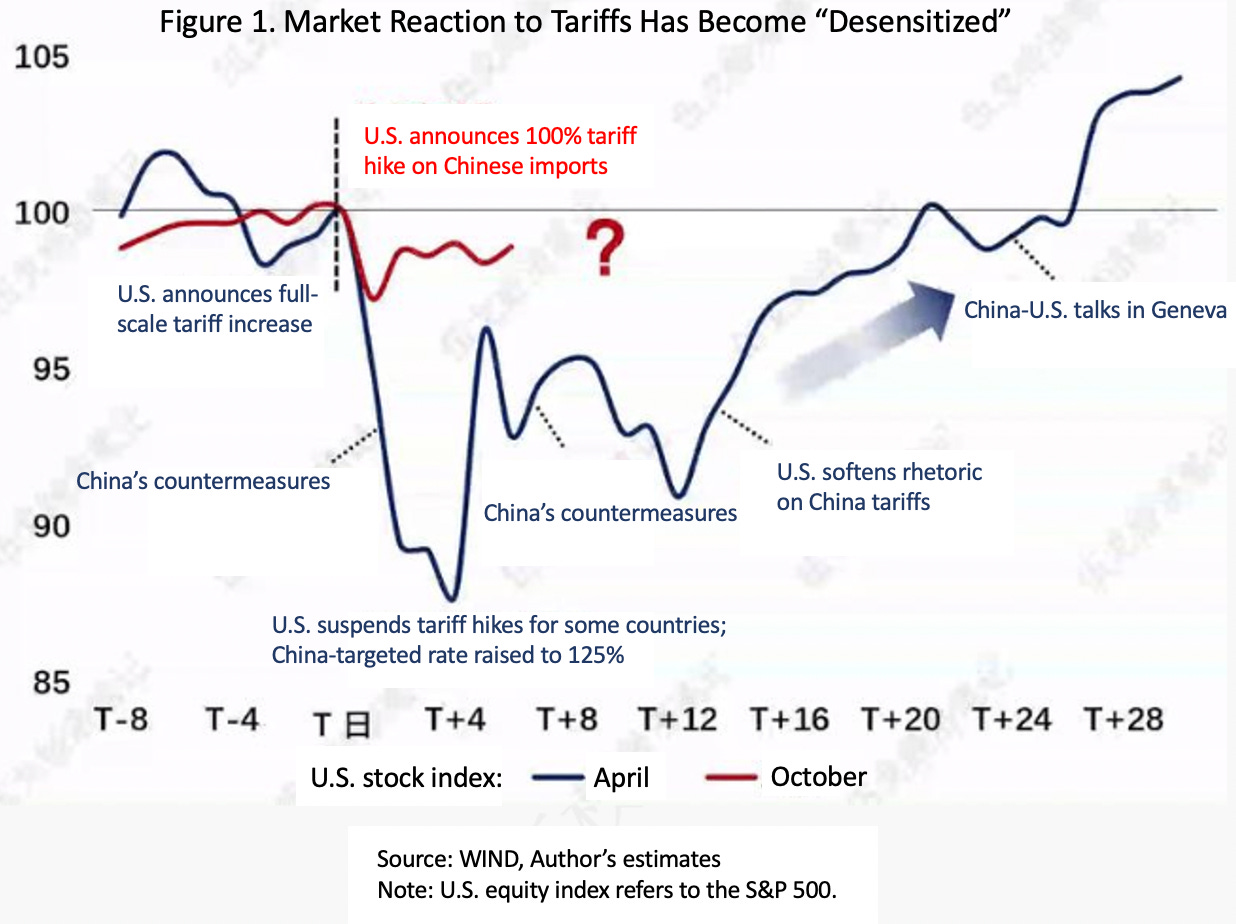

Although China and the United States have held multiple rounds of consultations, recent developments, such as restrictions on rare earth exports, shipping charges, and especially Trump’s renewed pledge to impose a 100% tariff, have sharply increased uncertainty in bilateral trade and economic relations. Unlike the first half of the year, however, financial markets have reacted calmly to this new wave of shocks. Does such a muted response mean the market has priced in the risks accurately? When external disruptions are so volatile, where can certainty be found?

I. External Disruptions: Escalation or De-escalation?

Since the beginning of this year, U.S.–China trade frictions have caused China’s exports to the U.S. to plummet. Yet, China’s overall export growth has remained unexpectedly strong. Measures such as rare earth controls have highlighted China’s growing initiative in responding to external disturbances. Meanwhile, Trump’s maximum pressure followed by compromise strategy has become familiar to the market. All this marks a significant departure from the tariff shock environment of early 2025.

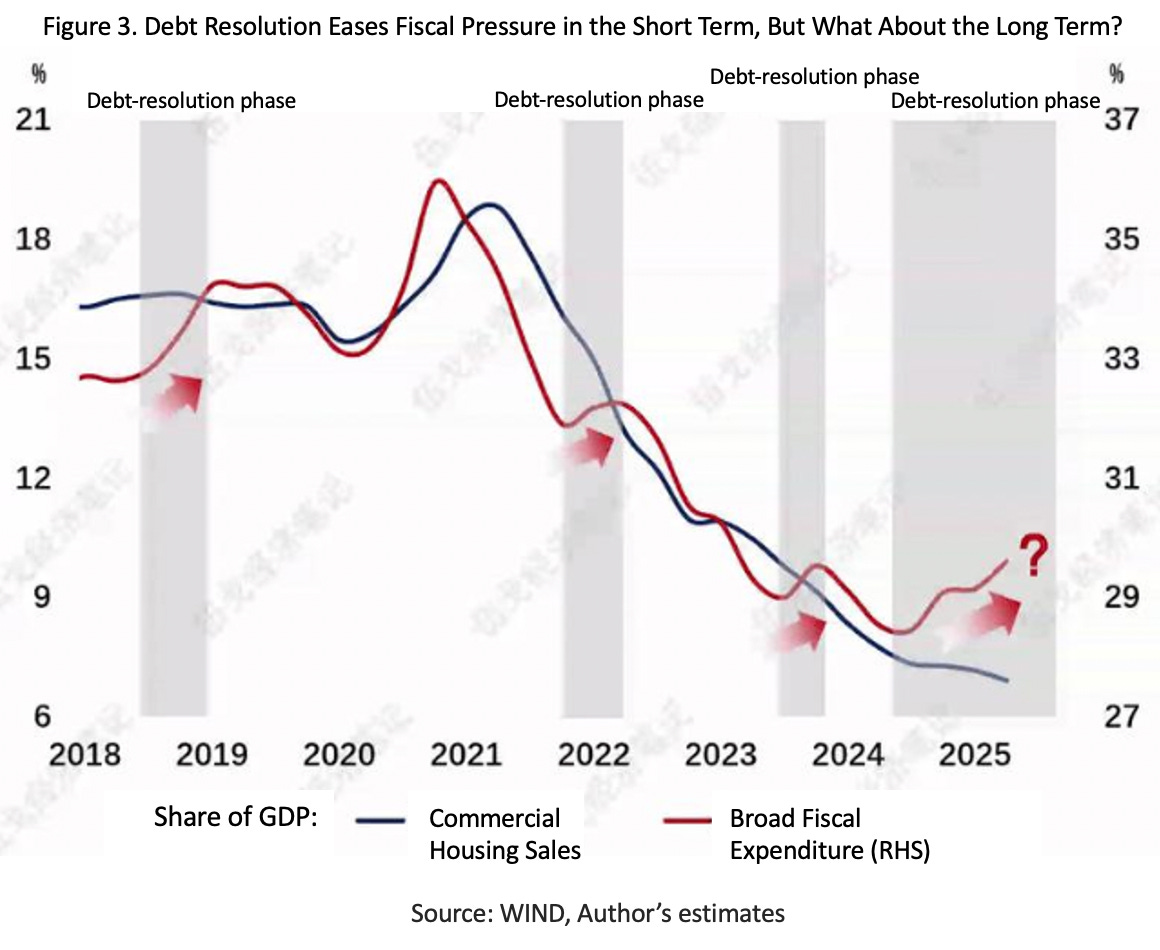

II. Domestic Responses: Short-Term Fix or Structural Solution?

On the domestic front, this year’s policy focus has been on debt resolution and expansionary fiscal spending. However, signs of mounting local debt repayment pressures are emerging; accounts receivable and bill default balances among local government financing vehicles (LGFVs) have both rebounded. The weakening property market during the traditional Golden September and Silver October season will further drag down future land-sale revenues for local governments. This will, in turn, heighten the urgency of front-loading debt-resolution quotas to ease fiscal strain.

Looking ahead, given that Trump remains constrained by midterm election dynamics and that China and the U.S. now hold a more balanced set of negotiating chips compared to April, a neutral trade agreement following rounds of bargaining appears likely. Over the long term, strengthening domestic substitution in key sectors and accelerating outbound investment will remain China’s pragmatic strategies for adapting to the normalization of external disruptions during the 15th Five-Year Plan period.

LIN Boqiang: The Introduction of China’s New Rare Earth Regulations Is Not a Radical Policy Upgrade

On October 9, China’s Ministry of Commerce issued two successive announcements — “Notice on Implementing Export Controls on Certain Rare Earth Items to Foreign Countries” and “Notice on Implementing Export Controls on Rare Earth-Related Technologies”, both of which will take effect on December 1. On October 12, the Ministry’s website published a Q&A session with its spokesperson regarding these new control measures and other recent trade policies.

According to the spokesperson, China’s export control over the relevant items is conducted in accordance with the law, with the goal of better safeguarding world peace and regional stability, and fulfilling international obligations such as non-proliferation. The Chinese side has fully assessed the potential impact of these measures on industrial and supply chains and is confident that the effect will be very limited. All export applications for legitimate, civilian purposes will be approved — relevant enterprises need not worry.

As another export control measure following those on gallium and germanium, this new regulation on rare earths not only rectifies and standardizes certain non-compliant export practices but also represents a necessary response amid the global contest over supply chains. Rare earths — known as the “vitamins of industry” and the “mother of new materials” — are indispensable in high-tech industries such as new energy, semiconductors, and aerospace. The timing of this new rule demonstrates China’s determination to safeguard its resource and environmental security and reflects a rational and reciprocal approach under the changing landscape of international competition.

A Reciprocal Rule Arrangement

For a long time, China has been the world’s core supplier of rare earths, accounting for more than 70% of global output. However, within the international value chain, China has often been confined to the raw-material stage — its resource value underappreciated while bearing a heavy environmental burden. The introduction of this new regulation signifies a shift in rare earth export management — from mere administrative approvals toward a more scientific, transparent, and operable regulatory framework, moving from “extensive control” to “refined management” and “security-oriented governance.”

A major highlight of this policy is the introduction of the “minimum content” and “direct product” rules. The announcement specifies that any foreign-made product containing 0.1% or more of Chinese-origin rare earth materials, or any overseas product manufactured using Chinese rare earth-related technologies, may fall under export control. This mirrors the “Foreign Direct Product Rule” in the U.S. Export Administration Regulations (EAR) — a form of reciprocal rule design.

For years, the U.S. has imposed restrictions on global products based on the origin of technology. China’s new approach in the field of resources and technology thus serves as a symmetrical response to such unilateral practices. It also sends a clear signal to the world: at the level of international trade rules, China has the legitimate right to establish a reasonable resource export management system based on its own security and environmental interests.

Meanwhile, the new rule features greater precision in execution. In the past, some companies evaded supervision by reprocessing or diluting rare earth contents abroad, leading to resource losses and environmental risks. The newly established 0.1% threshold effectively prevents such circumvention while avoiding “collateral damage” to products with negligible rare earth content.

This new regulation on rare earth exports is not a radical policy escalation but a targeted, internationally consistent, and reciprocal response. It addresses the real challenges posed by similar measures elsewhere and reflects China’s legitimate defense in terms of resource protection, environmental sustainability, and technological security.

A Rational and Restrained Response

The new rare earth regulation is more than an administrative adjustment; it is a measured response by China amid escalating international technological blockades. In recent years, the United States and its allies have continuously tightened restrictions on China’s advanced manufacturing and critical technologies — from “chip bans” to “entity lists” — in an attempt to expand their control boundaries. Against this backdrop, China’s reciprocal measures in the rare earth sector constitute a necessary act of defense for national security and industrial interests.

Rare earths are foundational raw materials for high-end manufacturing, playing an irreplaceable role in electric vehicles, motors and controls, aerospace, and artificial intelligence devices. China has developed systemic advantages in mining, separation, smelting, and magnet production. In the past, relatively loose export controls allowed core resources and technologies to flow abroad, leading to value leakage and waste.

By clarifying export licenses and technical review procedures, the new regulation brings these critical segments under supervision, fundamentally reducing external risks. More importantly, this management system is not a closed restriction, but an open mechanism based on security assessment. The announcement distinguishes between different uses and levels of sensitivity: exports involving military, terrorist, or weapons of mass destruction purposes are strictly prohibited, while general industrial or civilian technological cooperation applications will be reviewed on a case-by-case basis.

This tiered and categorized approach balances national security with international cooperation, demonstrating China’s pursuit of equilibrium between security and openness. Compared with the U.S., China’s measures emphasize responsiveness and proportionality. While the U.S. tends to adopt a “preventive, one-size-fits-all” approach, China’s policy is “conditional and bounded.”

Given the ongoing unilateral restrictions targeting China’s technological sectors, these countermeasures are necessary to prevent resource misuse and technology leakage. They also align with China’s growing environmental protection efforts. In essence, this is a rational, restrained, and effective strategic countermeasure.

A Deepening of Domestic Governance

Beyond reciprocity, this new export control policy on rare earths is deeply rooted in resource conservation and sustainable development. Rare earth mining imposes significant environmental costs, and years of high-intensity exports have exacerbated China’s ecological burden. Stricter export management under the new regulation helps steer the rare earth industry toward higher value-added and lower-emission segments, promoting greener and more efficient resource utilization.

At a deeper level, China’s rare earth policy is not only a response to international competition but also a domestic governance reform. By establishing clearer export standards, approval procedures, and compliance responsibilities, it provides strong safeguards for technological, environmental, and industrial security in the future. This marks a transition in China’s resource management — from quantity expansion to quality enhancement, and from passive reaction to proactive protection.

Moreover, the regulation signifies a shift in China’s approach to global supply chain governance. Faced with external high-tech containment, China has chosen not to respond confrontationally but to act within international norms while emphasizing resource sovereignty. This reciprocal rather than antagonistic approach enhances China’s security in key areas and demonstrates policy rationality befitting a responsible major power — one conducive to world peace and regional stability.

Overall, this new rare earth export control is far more than a simple policy adjustment. It represents China’s effort to strike a balance between resource security and international rules — a reciprocal response to external technological blockades and a strategic reinforcement of domestic resource and environmental protection. Looking ahead, China’s rare earth policy is expected to maintain a balance between open cooperation and secure protection, safeguarding national interests responsibly while contributing to the stability and sustainability of global supply chains — and to world peace.

Conclusion

China’s rare earth policy is not a retaliatory move but a step toward lawful, transparent, and sustainable resource governance. By moving from a major producer to a global rule-maker, China aims to establish fairer and more predictable supply chains. This shift reflects a broader commitment to balancing national security with global cooperation. Through institutionalized regulation and multilateral dialogue, China seeks to strengthen trust, ensure resource stability, and contribute constructively to a more resilient global economic order.